KYC processing had been an essential, constitutive, but a laborious task for financial institutions, public & private, and telecom service providers. KYC being a recurring process, needs to be done every few years with millions of customers, to continue to provide uninterrupted services.

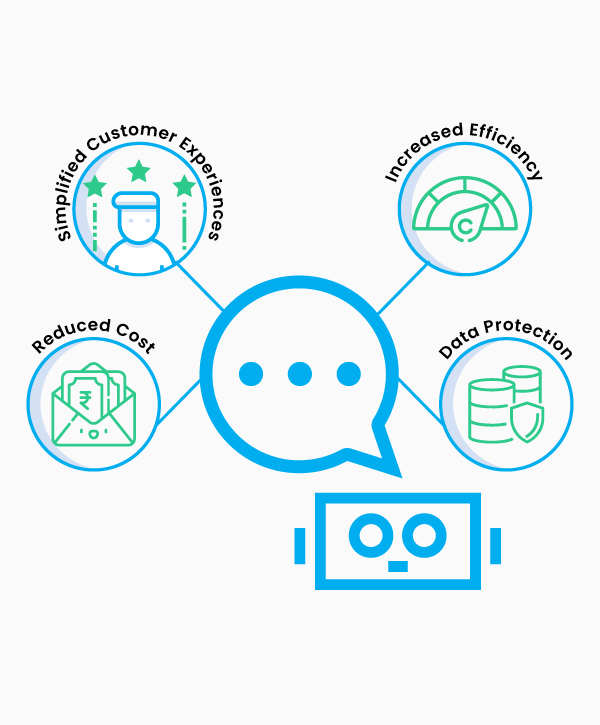

Enterux KYC Bots automates the entire process of collecting and verifying customers’ documents through intelligent chatbots. Data is extracted and archived at a location of choice for data protection and easy accessibility.

Customers access Enterux KYC Bot on browsers of their choice; it is an app-less system, no pre-downloads. Customers respond to questions posed by the bot, send the snapshot of the required documents through mobile, laptop, or any other device.

Automation of this entire system increases efficiency significantly and saves time. In a day and age when service excellence is the benchmark, Enterux KYC Bot helps banks and NBFCs stay ahead in the game by providing efficient services to their customers. It allows enterprises dealing with millions of customers, interact from their respective locations simultaneously.

In a traditional setting, workforce, whether employed or outsourced is used to collect, verify, store, or even archive or retrieve documents. It is not only time-consuming but brings a huge cost to the enterprise. Automation reduces manual intervention, eliminate redundant processes and makes it overall cost-effective.

Reduced manual intervention automatically reduce data error and data theft. Seamless processing and archiving of documents on secured in-premise servers ensures data protection. Enterux KYC Bot software is periodically updated with the required safety protocols.

KYC Bot v/s traditional KYC

Send link to the customers to initiate the KYC process.

On clicking the link, the customer will be taken to an online uploader. They will then send the snapshot of the document through the secured server.

Enterux KYC Bot will verify the documents, process it, encrypt it and save it securely to the servers.